Lecture on power-law distributions

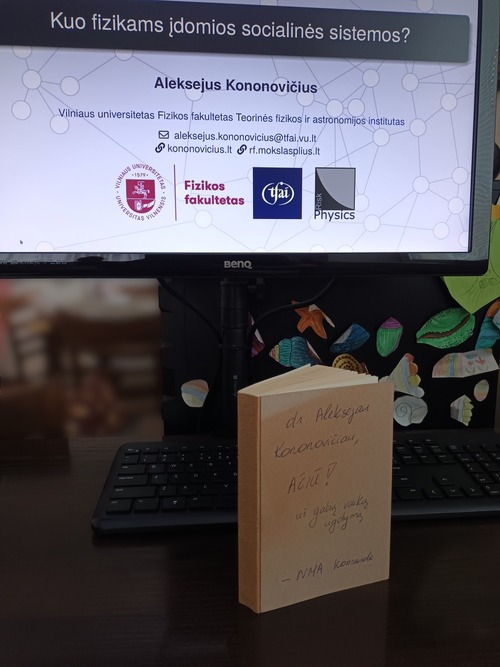

This year I was invited to give lecture to gifted high school students attending Nacionalinė moksleivių akademija. It was a great experience for me. I hope that my lecture was at least a bit useful and inspiring. You can find the slides here.

Immediately after the lecture I have remembered that have forgotten to make an important philosophical point, and to somewhat contradict the conclusion made by Veritasium in a recent video on power-law distributions.

In the video's thumbnail, one can see a claim that "working hard is not enough." I do agree with this point, but by the end of the video, one of the hosts (Casper) suggests that in a power-law world, it becomes "more important to be persistent than consistent". This interpretation is sound, and the emphasis on persistence seems both intuitive and motivating. That said, it is important to add a nuance to the discussion.

In environments governed by power laws, outcomes are often heavily influenced by chance and/or external factors. As a result, many considerable successes cannot be fully explained by individual qualities such as ability, persistence, or consistency alone. From this perspective, persistence may increase exposure to opportunities, while the ultimate magnitude of success remains strongly shaped by factors outside individual control. The point I am trying to make is well-presented in the Talent vs Luck model.

Similarly, the wealthiest agents in kinetic exchange models with savings are the ones with largest saving propensity. These agents are successful because they contribute to the shared pot the least, while having a chance at receiving an equal share of the pot back.