Redistribution in Talent vs Luck model

Here we continue our discussion on the Talent vs Luck model proposed by [1]. This time we introduce capital redistribution strategies in to the model, unlike the original authors we do not allow policy makers to create capital - instead they must take from somebody and only then they can redistribute.

Redistribution strategies

No redistribution strategy refers to the model as implemented in the original post.

Flat tax, uniform redistribution. The capital for redistribution is taken from every agent by applying flat tax rate \( R \) on their capital. Then the collected funds are split equally among all agents.

This strategy diminishes the effect of luck on capital, but does not eliminate it completely. Luckier agents still get more money than less lucky ones. Total wealth increases.

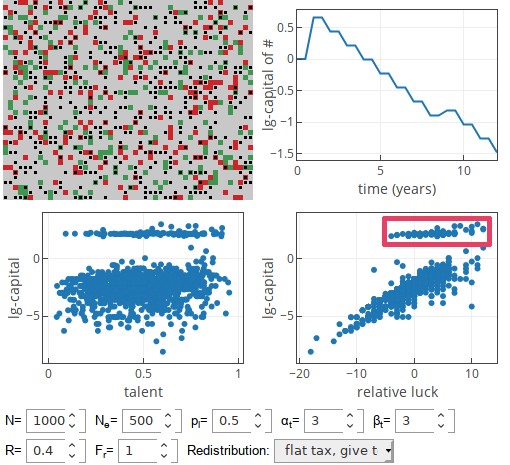

Flat tax, give to 10% best. Once again the capital for redistribution is taken from every agent by applying flat tax rate \( R \) on their capital. Yet in this case the funds are split between top 10% agents. While this is very unrealistic scenario in society, this is (arguably) what is effectively done in scientific community via grant system (and the reason why most scientists are not happy with such system) [1, 2].

This strategy puts huge emphasis on initial luck. As the time goes on, the agents who were lucky in the beginning split from the rest and now two clusters are observed. Total wealth decreases.

Fig. 1:Results of a random simulation with 'flat tax, give to 10% best' redistribution strategy.

Fig. 1:Results of a random simulation with 'flat tax, give to 10% best' redistribution strategy.Progressive tax, uniform redistribution. Tax rate \( R \) is applied to the richest individual only, other agents are taxed at lower rates (which decrease linearly). The collected funds are split equally among all agents.

This strategy also diminishes the effect of luck on capital, but does not eliminate it. Total wealth increases.

Some notes

No strategy has noticeably increased the impact of talent on capital. This is actually likely to be impossible, because we can't observe and reward talent directly.

While it is very tempting, but one should refrain from directly comparing flat and progressive taxes. While the effect they have seems to be similar, the meaning of \( R \) is different in the two cases.

All strategies are applied each \( F_r \) years.

HTML 5 app

Feel free to explore a new app, which is essentially identical to the one from the original post. It just shows three different plots.

References

- A. Pluchino, A. E. Biondo, A. Rapisarda. Talent versus Luck: The role of randomness in success and failure. Advances in Complex Systems 21: 1850014 (2018). arXiv:1802.07068 [physics.soc-ph]. doi: 10.1142/S0219525918500145.

- R. Sinatra, D. Wang, P. Deville, C. Song, A-L Barabasi. Quantifying the evolution of individual scientific impact. Science 354: 3612 (2016).