V. Gontis: Annoying real GDP argument against Euro

Though Paul Krugman is among the most prominent critics of the Euro idea [1], there are many other professional economists and journalists criticizing the macroeconomic policy of Euro zone. The problem of Greece has become one of the most disputable because there is permanent pressure of opinions ranging from a flat denial of Euro project to the uncompromising critics of all steps in the process of its implementation. "Realize," the main problem of the European development arises from the bad idea and implementation of common currency and the whole EU project gets stuck on this idea.

It is not our task to discuss possible geopolitical circumstances of such purposeful opinion flow; we just want to draw attention that very often these opinions are based on the fault argument. There is a flow of new articles [2,3] making a comparison of real GDP growth of European countries already in Euro area or pegged to Euro with countries still having floating currency policies. There is no necessity to be an expert of international macroeconomics to comprehend the relation between monetary policy and real GDP growth. Floating currencies force to adjust local level of prices to the new exchange rates shifting division between inflationary part of GDP (deflator) and real GDP. This makes real GDP dependent on local currency fluctuations and less appropriate for economic growth comparisons between countries. This problem is well understood by statisticians of economic growth and GDP alternatively is calculated in purchasing power parities PPP, where price level is discounted when measured in common units (currency).

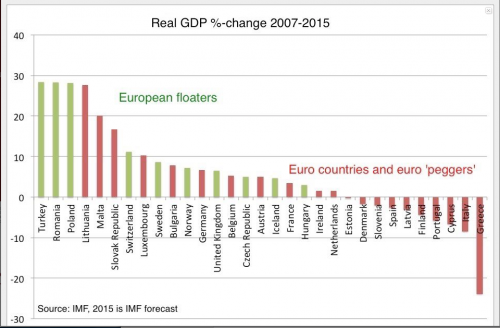

It is hard to imagine, that P. Krugman does not know these limits for use of real GDP, nevertheless, he and very many his followers build their macroeconomic arguments and compare performance of countries based on this very limited GDP measure. Lets take more careful look at data provided by recent authors [2,3]. Lars Christensen has published his comments on real GDP growth data in Europe for the period 2007-2014. For your convenience we just repeat Lars’s figure:

Fig. 1:Real GDP %-change 2007-2015, published by Lars Christensen.

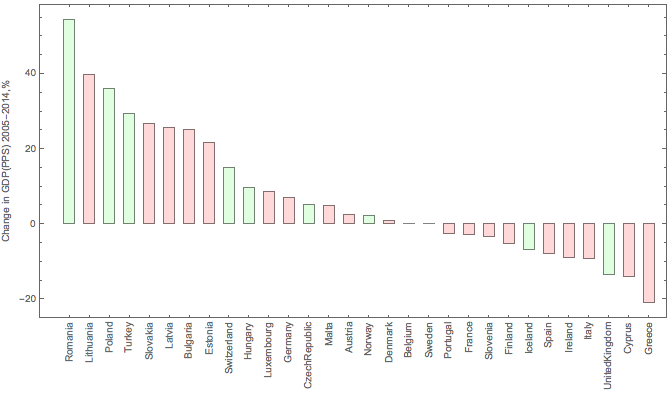

Fig. 1:Real GDP %-change 2007-2015, published by Lars Christensen.Lets compare with next figure, making correct comparison of economic growth in Europe, where GDPs are measured in purchasing power standards (EuroStat data). The imagined advantage of floaters obviously disappears together with all arguments revealing Euro strangulation force. One can easily check these results for various time periods, at least starting from 1995 as EuroStat gives us. Our general conclusion is that GDP growth data of European countries do not provide statistical evidence of advantage for any of these monetary choices. There is some tendency that floating currencies work better in short time period and pegged currencies work better in long time period. There is strong evidence that Baltic countries with their pegged currencies are more successful than Vysegrad countries with their floating currencies caching up developed European countries [4].

Fig. 2:Real GDP %-change 2005-2014, evaluated from EuroStat data in PPS.

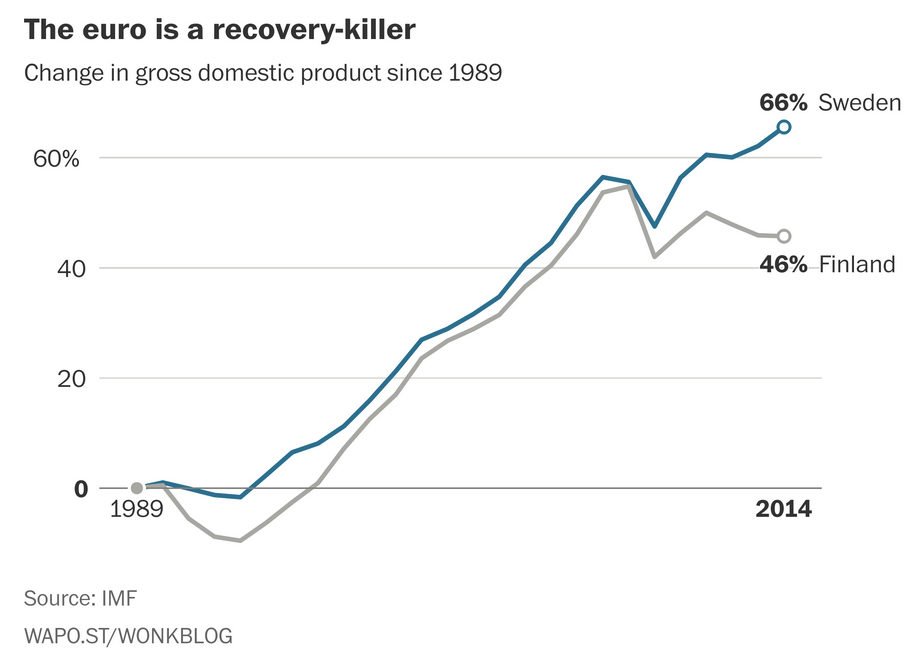

Fig. 2:Real GDP %-change 2005-2014, evaluated from EuroStat data in PPS.The article published by Matt O’Brien in The Washington Post [3] is a nice piece of very convincing text promoting ideas of the new monetary ideology [5]. The problem is that with incorrect quantitative arguments one is able to please the ideology but cannot serve the truth. Lets compare the figures. First we provide comparison of Sweden and Finland given in The Washington Post by Matt.

Fig. 3:Comparison of GDP percentage change between Finland and Sweden starting from 1989.

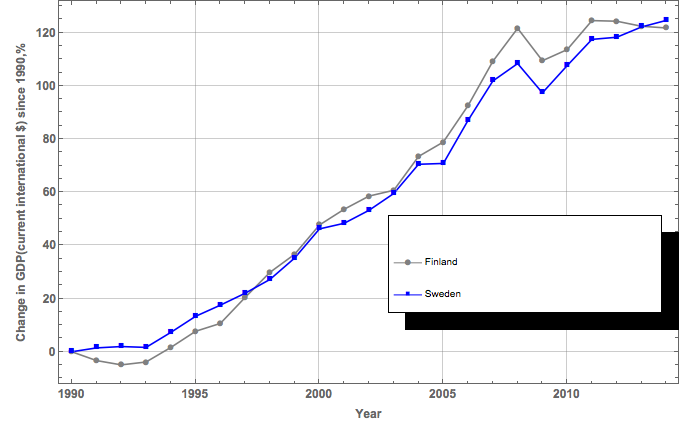

Fig. 3:Comparison of GDP percentage change between Finland and Sweden starting from 1989.Though there is no direct statement that comparison is made in real GDP, one can easily figure out it by comparing with our figure, where percentage change of GDP calculated in current international dollars (PPP data from World Bank) in the period from 1990 is given. This data proves that long-term recovery of Finland is much stronger than of Sweden. The current problem of Finland related with Nokia just needs the time to be solved in the long-term macroeconomic level.

Fig. 4:Comparison of GDP percentage growth between Finland and Sweden evaluated in current international dollars (PPP data from World Bank).

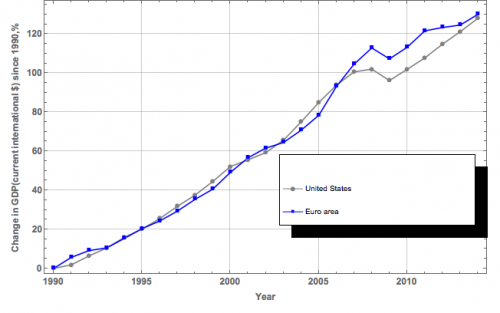

Fig. 4:Comparison of GDP percentage growth between Finland and Sweden evaluated in current international dollars (PPP data from World Bank).These and other cases, when prominent authors and Media use fault argument of real GDP growth already have become really annoying for those, who still rely on statistical data as a source of information on economic growth. Nevertheless, lets compare the growth of Euro zone and US for the more complete picture of this annoying problem.

Fig. 5:Comparison of Euro zone and US.

Fig. 5:Comparison of Euro zone and US.